Self-employed in Germany? With Accountable you stay on top of your finances - bookkeeping, invoicing, banking, and taxes. All in one place.

Get started for free

File your taxes with confidence. Join 40,000+ self-employed in Germany 🇩🇪 who trust Accountable for expert support, AI-powered accuracy, and hassle-free tax filing. The #1 app for finances, built for you.

Our team helps with questions about bookkeeping and taxes via phone, chat or email.

Error-free tax returns thanks to our Tax Guarantee, supported by AI.

Our tax coaches or partner tax advisors will help you.

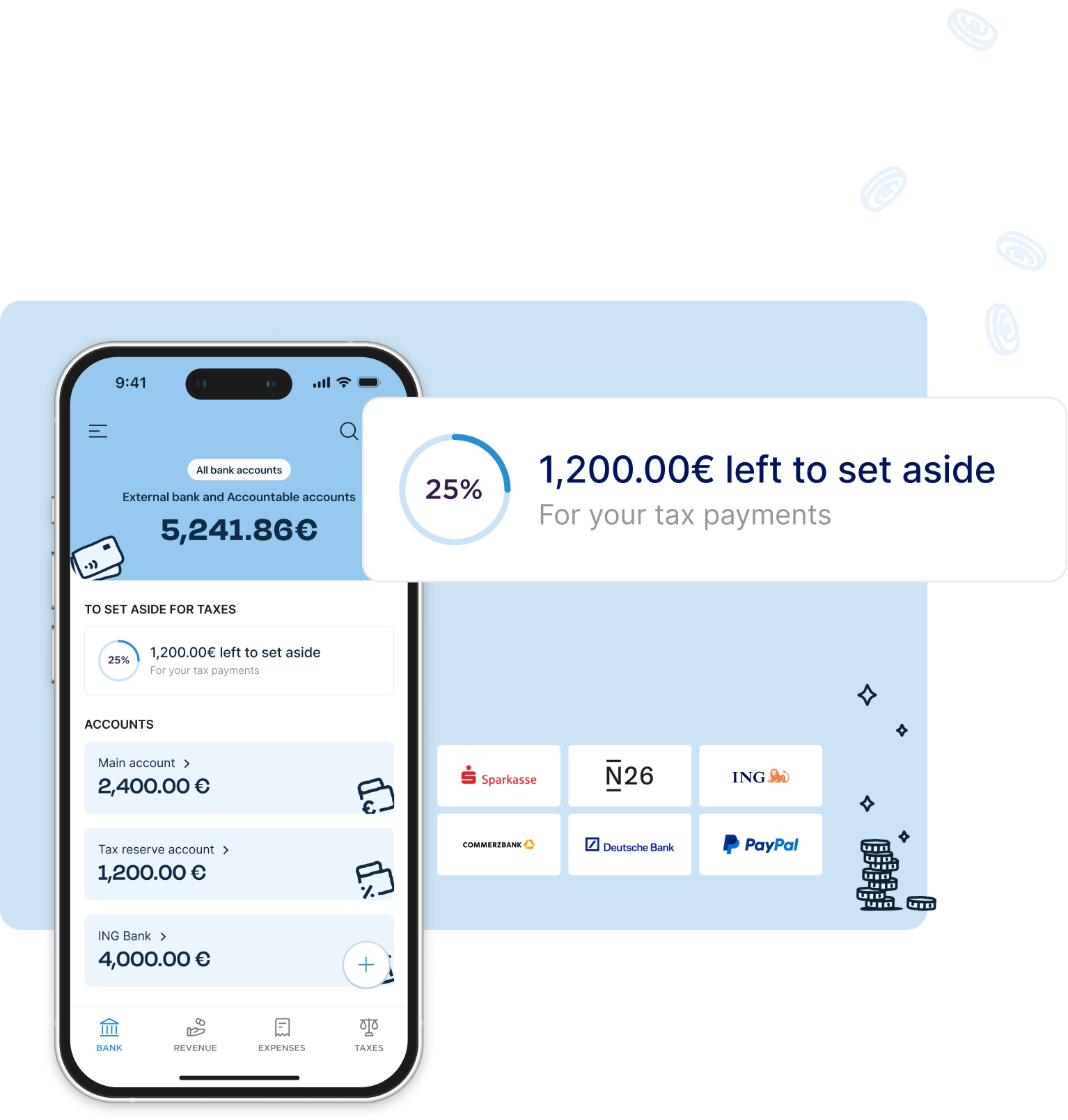

Marciela, Shop owner and designer about Accountable Banking

“Automatic tax savings with my bank account – so convenient.”

Lucas, Freelance consultant about Accountable Invoicing

“Moving to PEPPOL was seamless with everything in one place”

Karim, Owner of a coffee shop about Accountable Bookkeeping

“Scanning and attaching receipts with automatic recognition of all content. Magic.”

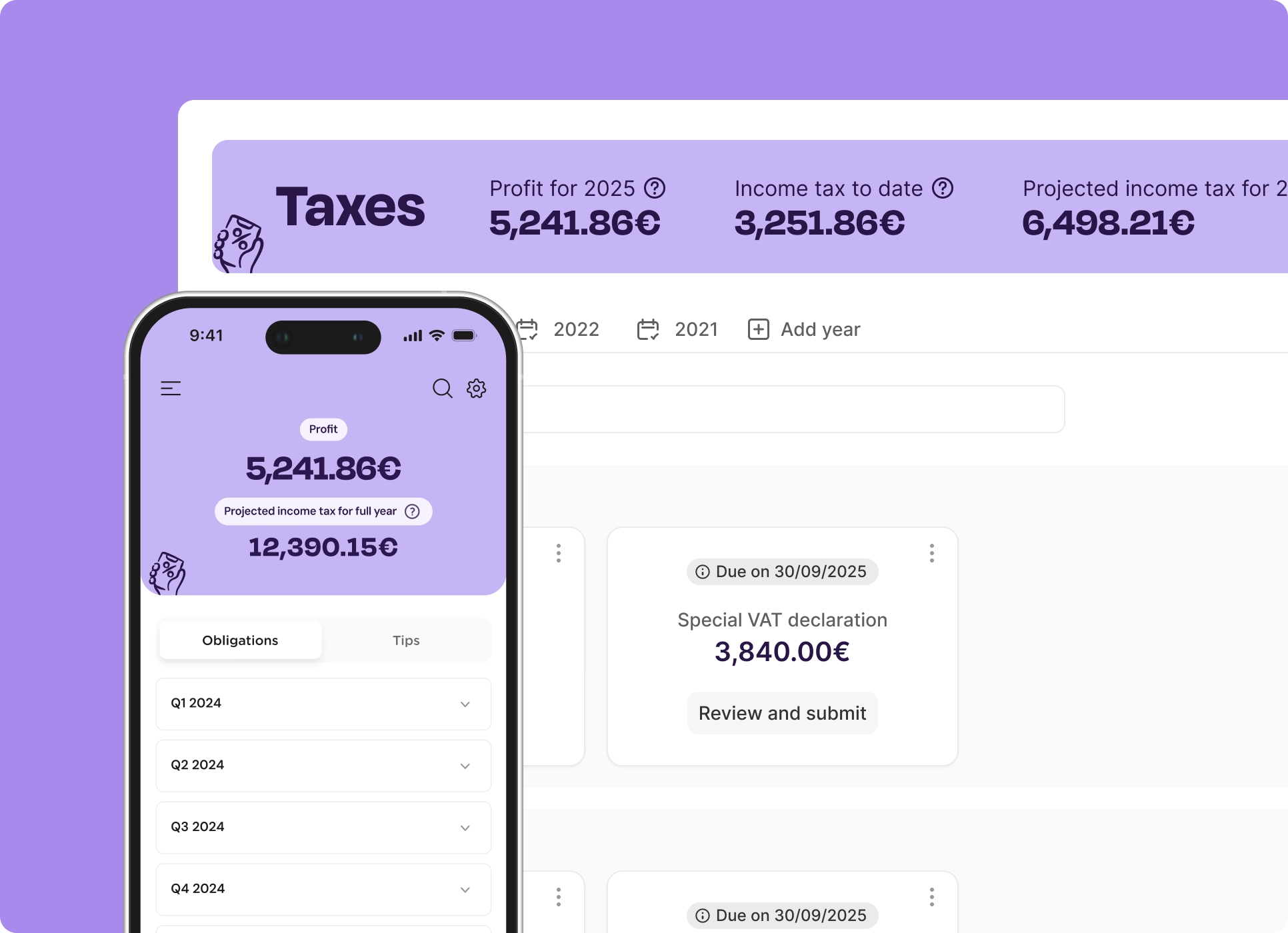

Layla, Business owner and architect about Accountable Taxes

“No need to know about accounting and taxes.”

AI Tax Advisor

Get instant answers to all your tax questions 24/7 – covered by our Tax Guarantee

All our tax and accounting knowledge is manually vetted by experts.

AI can be wrong. Consider checking important information. Conversations may be reviewed for quality assurance.

What data is shared?

Tax Coach Germany

Hanna

Tax Coach Germany

Anne

Tax Coach Germany

Franzi

Tax Coach Germany

Simon

Tax Coach Germany

Robert

Founder Germany

Tino

Tax Coach Germany

Sophia

Tax Coach Germany

Esther

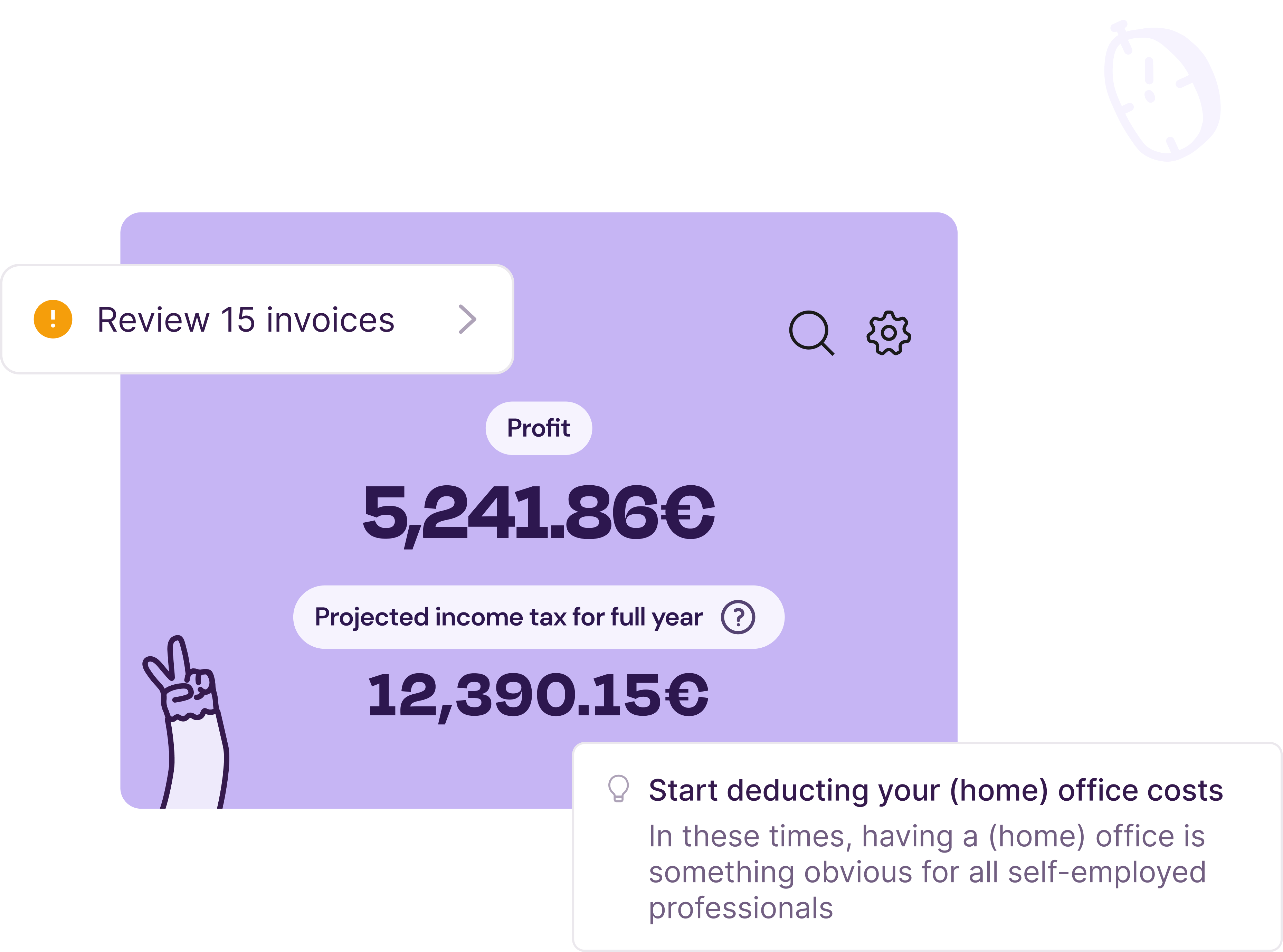

Being self-employed means wearing many hats. You’ve got things under control, but sometimes it helps to double-check. That’s why our tax coaches are here to answer your questions—so you can move forward with confidence.

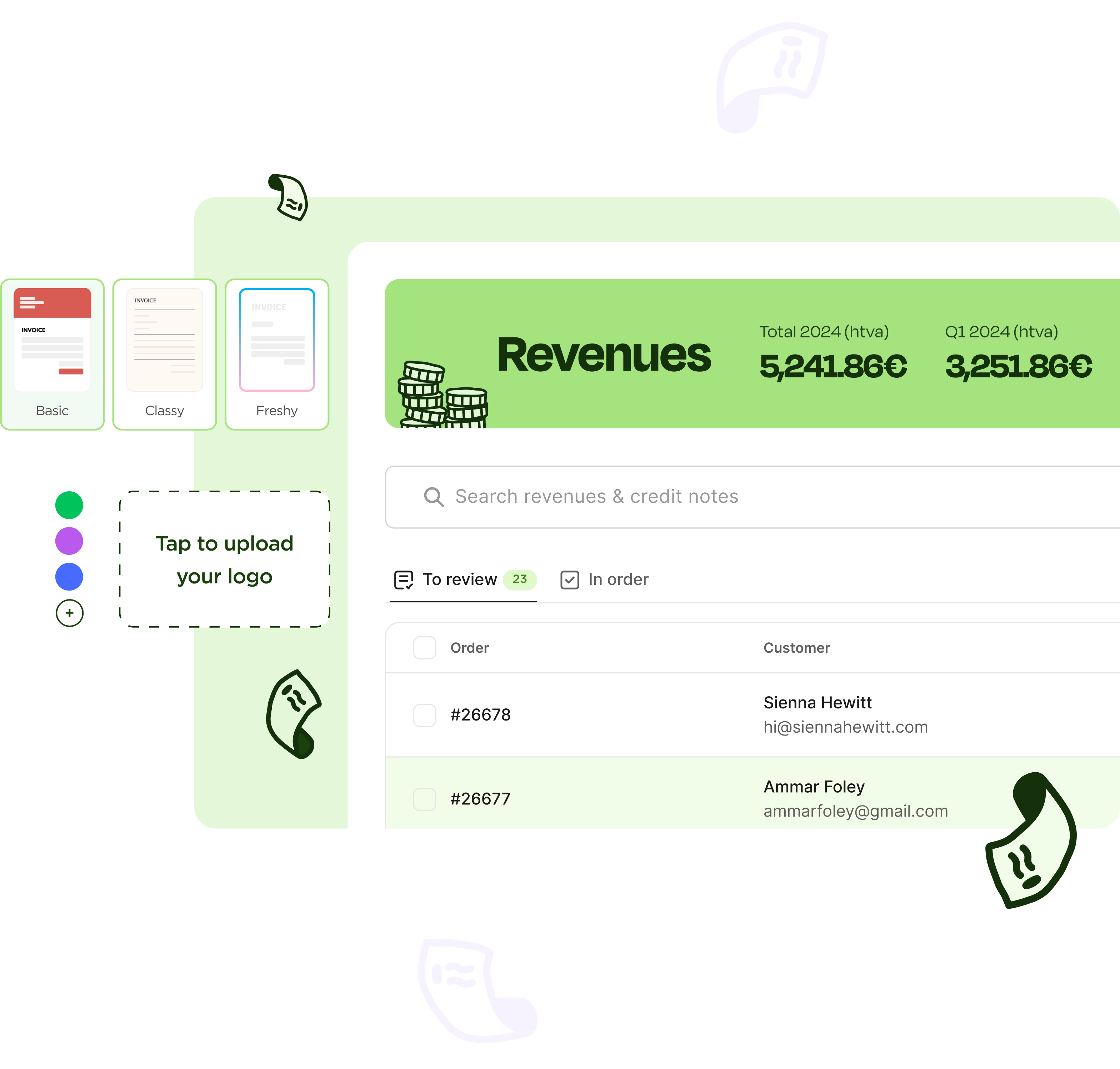

Avoid costly mistakes and send invoices that your client can pay directly

Our tax guarantee: In the case of errors due to Accountable, we will refund resulting back taxes up to 500€

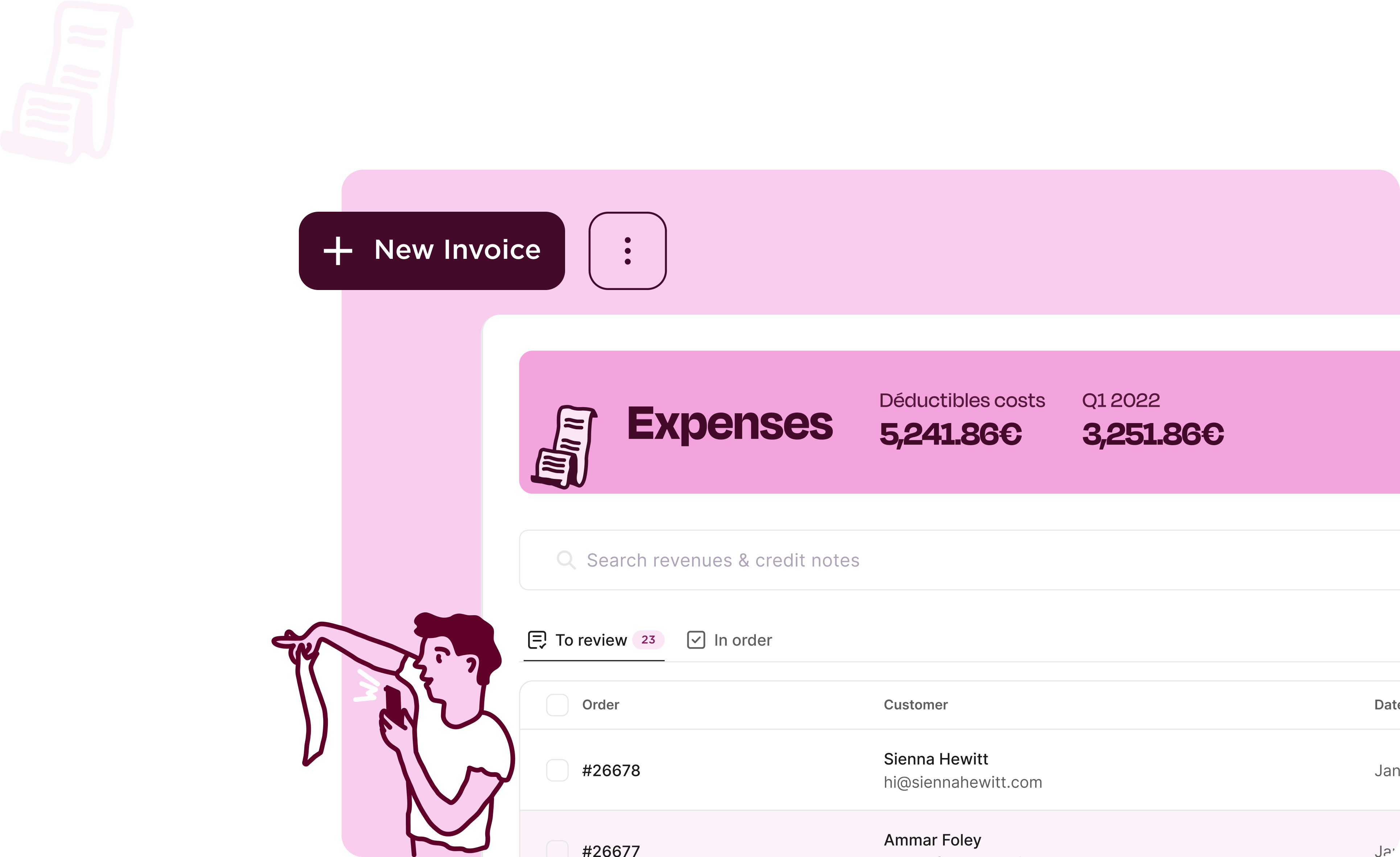

Automate your expense management and save taxes with every receipt

Start with Accountable Banking or connect your existing bank accounts and the app shows you how much money is left after taxes

Choose our FREE plan for your invoicing or discover our gain full independence starting from € 15.50 / month.

€0

Free e-invoicing and banking for all self-employed

€15.5

per month on yearly plan (excl. VAT) instead of €18.5 on monthly plan

Invoicing, banking and taxes all in one place

€22.5

per month on yearly plan (excl. VAT) instead of €33.5 on monthly plan

Extended tax guarantee, personal tax coach and 2% cash bonus

The unique advantage is that in addition to bookkeeping, you can also do your private tax return with Accountable. This way, you always have your invoices, expenses, profit and taxes under control.

In addition, you benefit from the Accountable tax guarantee: In the event of errors due to the Accountable app, we will refund any resulting back taxes up to €500 or €10.000 in the extended guarantee.

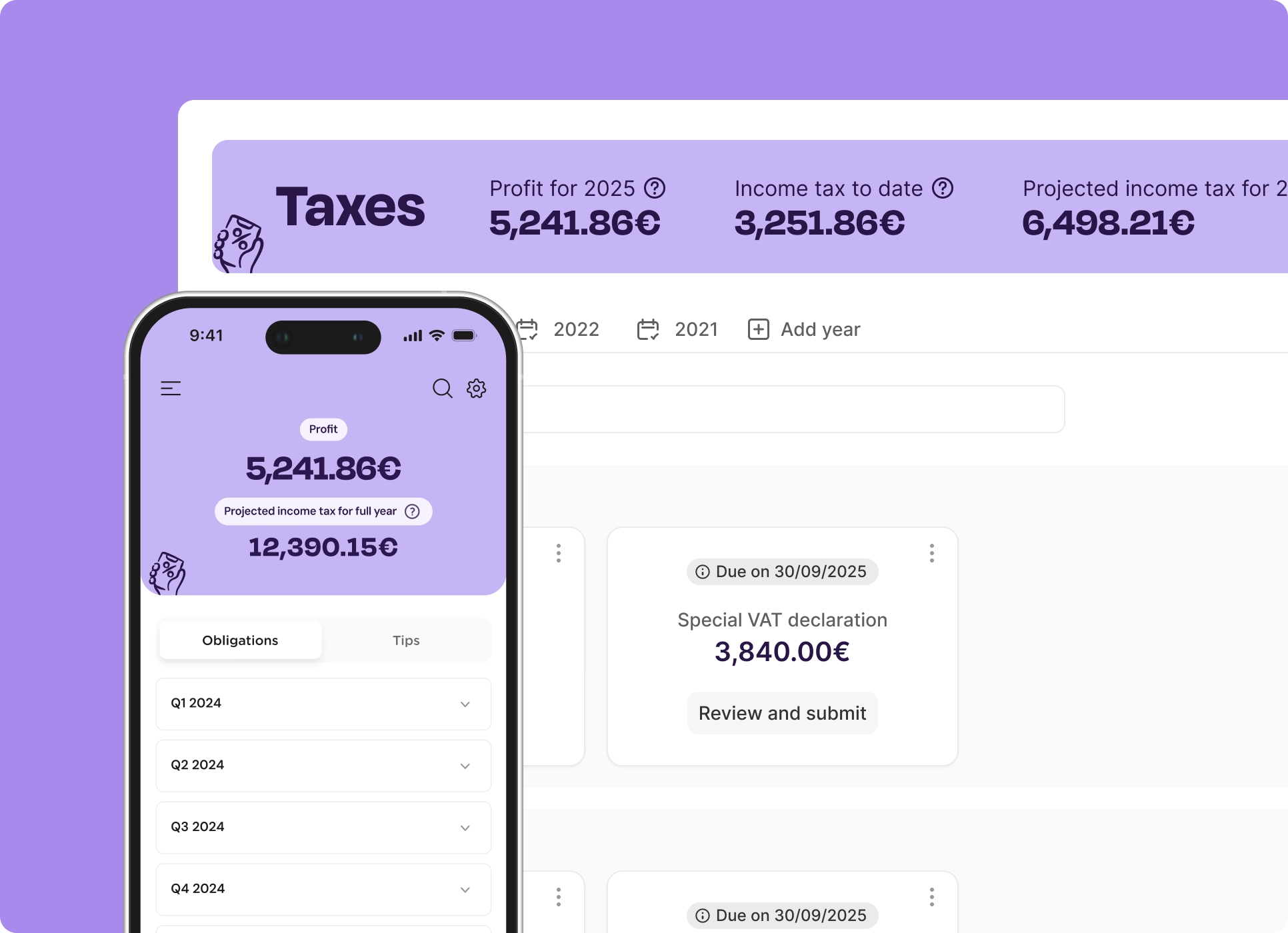

You have all this in the web version on your desktop or on-the-go in the app at any time.

Yes, Accountable is particularly suitable for Freiberufler (freelancers), you have everything you need for bookkeeping and taxes in one tool. Whether you want to scan the invoice from your coffee with your client on the go, send your customised invoice at the end of the day, or submit your VAT return on time and without much effort – with Accountable you save money and time.

Yes, because you can also find your Gewerbesteuererklärung (business tax return) directly with us – a service that no one else offers.

Accountable adapts to your individual tax situation and helps you save tax

Yes, we have developed Accountable specifically for the self-employed and Kleinunternehmer (small business owners). Our GROW plan offers all the features you need as a Kleinunternehmer: you can prepare your annual income tax return, create correct Kleinunternehmer invoices and scan and save your expenses. In GROW, you’re also covered by our tax guarantee. You get all this for €15,50 a month.

Accountable automatically adjusts to your individual tax situation. If your business is doing better than expected and you want to switch to standard taxation, you can easily change this in your account and the settings will adapt to your new situation.

Currently, Accountable is optimised for freelancers and trade persons. For example, our software supports the profit & loss statement (EÜR) for easy profit determination. Feel free to contact us via chat or email ([email protected]) if you have further questions. We work with certified tax advisors who can offer you further support.

If you use Accountable, you usually don’t need any further tax advisor or accountant. Because our solution offers you all the functions you need to manage your accounting and taxes independently – even without prior tax knowledge.

With our tax guarantee, you are additionally protected, because our AI-based software ensures that you do not make any mistakes. If there is a mistake due to the Accountable app, we’ll refund any resulting back taxes up to €500!

Of course, Accountable gives you the freedom to decide how you want to work. If you like to work with a tax advisor, you can simply invite them to Accountable and they will have access to your account via the personal tax advisor access. You can also export all data in DATEV format if required.

With its PSD2 license, Accountable is under the supervision of the Federal Financial Supervisory Authority (BaFin) in Bonn (Directive (EU) 2015/2366) and has the strictest security procedures to protect your data. We are regularly audited and have strict reporting requirements. We use recognized security standards (256-bit SSL certificate) to encrypt your confidential data.

Without the trust of our users, Accountable cannot succeed. We do everything to protect the data and security of our users.

You can test the full functionality of Accountable for the first 14 days (no payment required). After that, you can continue to use the Accountable app free of charge for as long as you like.

The free version gives you access to up to 5 documents. You can either write invoices or scan expenses. There are no costs and you don’t have to sign up for a subscription.

If you want unlimited use of all Accountable features, you can switch to our PRO or GROW plan (for Kleinunternehmer). This gives you the possibility to do your tax returns and VAT returns. In addition, in PRO you can not only access the app but also edit everything on your laptop in the web version.

Accountable PRO costs €33,50 per month (monthly subscription) or €22,50 per month (annual subscription). With PRO MAX you get a higher tax guarantee, personal support and 2% bonus on all your invoices for 45€ per month (monthly subscription) or €34,50 per month (annual subscription).

Accountable GROW is made for all self-employed people who benefit from the Kleinunternehmer regulation (< 25.000€ turnover). Just like Accountable PRO, with GROW you can file all your tax returns and do all your bookkeeping from your desktop or smartphone. GROW costs €18,50 per month (monthly subscription) or €15,50 per month (yearly subscription). GROW MAX costs €33,50 per month (monthly subscription) or €22,50 per month (yearly subscription)

You can read more about our pricing here.

The AI Tax

Advisor supports you with your taxes and answers all your questions about taxes, bookkeeping and self-employment.

This is because the unique AI is specialised in German tax rules and can also take your personal situation as a self-employed person into account in its answers.

That’s what the AI Tax Advisor can do for you:

The Accountable AI Tax

Advisor gives you personalised tax tips so that you can meet all your tax obligations without errors and have every possible question answered.

Not only can the AI talk to you, it can also do things for you. For example, your details are automatically checked for errors. So you can be sure that your tax return is correct.

How do we do it?

What about privacy and control? This is of course particularly important to us. That’s why you decide at any time what information you share with your AI Tax Advisor.